Rachel Reeves suffered another blow ahead of the Spring Statement today as government borrowing smashed expectations.

The public sector borrowed £10.7billion last month – the fourth highest February figure on record and more than the £7billion analysts had pencilled in.

The £132.2billion total for the year to February is £20.4billion more than the Treasury’s OBR forecast as recently as October.

The gap was driven by higher spending on public services, including social benefits, and came despite tax revenues being sharply up on the same time in 2024.

The Office for National Statistics (ONS) data lay bare the scale of the challenge for the Chancellor when she delivers her fiscal statement on Wednesday.

The £132billion total for the year to February is £20.4billion more than the Treasury’s OBR forecast as recently as October

The Office for National Statistics (ONS) data lay bare the scale of the challenge for the Chancellor (pictured) when she delivers her fiscal statement on Wednesday

The public sector borrowed £10.7billion last month – the fourth highest February figure on record and more than the £7billion analysts had pencilled in

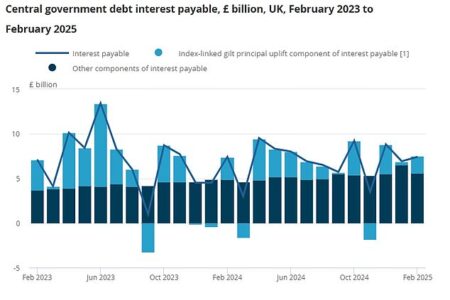

High debt interest costs have helped worsen the picture for Ms Reeves

The figures are too late to affect the OBR’s new forecasts for the Spring Statement, with the final versions due to be delivered to the Treasury today.

However, they give a grim indication of the weakness in the government’s books.

Experts believe Ms Reeves needs to fill a £10billion black hole – or possibly more – despite already having announced £5billion in curbs to benefits.

Her Autumn Budget plans have been trashed by an alarming slowdown in economic growth and rising debt interest costs – with fears the national insurance raid and Donald Trump’s trade war are about to make things worse.

Ms Reeves has ruled out tax changes at this stage, meaning that the money will need to be found from spending cuts.

But Labour MPs are already gearing up to resist anything that resembles austerity.

Chief Secretary to the Treasury, Darren Jones said today: ‘We must go further and faster to create an agile and productive state that works for people.

‘That’s why we’re refocusing the public sector on our missions and, for the first time in 17 years, going through every penny of taxpayer money line by line, to make sure it is helping us secure Britain’s future through the Plan for Change.’

The ONS said public sector net borrowing was £100million more than in February 2024.

It was also £4.2billion more than had been forecast by the OBR for the month.

Jessica Barnaby, the ONS’s deputy director for public sector finances, said: ‘At £10.7 billion, public sector borrowing in the month of February was virtually unchanged on the same month last year.

‘However, borrowing over the financial year to date was up nearly £15 billion on the equivalent period last year.’

IFS Senior Research Economist Isabel Stockton said the figures ‘underscore the challenges facing the Chancellor’.

‘The forecast will include costings for cuts and a tightening of eligibility for health-related benefits announced this week, although as we have seen from previous reforms the eventual impact will depend on the way individuals respond to the changes,’ she said.

‘There are risks here. But having boxed herself in with promises to meet her fiscal targets, not to raise taxes further and not to return to austerity for public services, easy or risk-free options for the Chancellor are in short supply.’

Alison Ring, ICAEW Director of Public Sector and Taxation, said: ‘The Chancellor will be disappointed that late self-assessment tax receipts were not sufficient to offset overruns in public spending ahead of the Spring Statement.

‘Although today’s data is too late to be reflected in the OBR forecast the Chancellor will present to Parliament next Wednesday, it will still influence her thinking about whether to cut the amount of public spending allocated to this summer’s three-year Spending Review.

‘Any potential improvement to the public finances caused by the proposed cuts to welfare are a long way off so the key question is whether the Chancellor can avoid major decisions on further tax rises ahead of the Autumn Budget later this year, or if pressures from today’s numbers will force her hand.’