Women face working until they drop, they were warned last night, after a sudden surge in the number of those aged 65 and over in employment.

Figures yesterday showed a record one in ten women aged 65 and over are now in work.

Experts said many are now unable to afford to retire after a rise in the female state pension age – bringing it in line with men before it is set to increase further for both.

It means at a time when many might have been expecting to look after the grandchildren, go on cruises or simply put their feet up in the garden, they are still setting their alarms and clocking on.

While many are happy to do so, pensions experts last night warned others feel they have no choice but to soldier on.

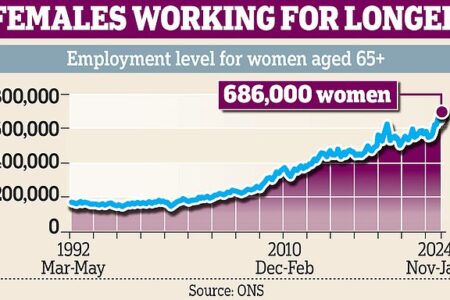

The total number of women aged 65 and over who are working now stands at 686,000 after an increase of 135,000 over the past 12 months, according to the Office for National Statistics (ONS).

That surge accounted for nearly a quarter of the total 608,000 rise in employment over that period.

Former pensions minister Sir Steve Webb, now a partner at pensions consultants LCP, told the Mail that the issue of those who ‘cannot afford to retire’ was becoming increasingly pressing.

Another blow to older people’s incomes came when Rachel Reeves last year decided to remove Winter Fuel Payments for millions of pensioners

Figures yesterday showed a record one in ten women aged 65 and over are now in work

The total number of women aged 65 and over who are working now stands at 686,000 after an increase of 135,000 over the past 12 months

‘It may be that these figures are the canary in the mine, and we have a lot more of this to come,’ he added.

Simon French, chief economist at City broker Panmure Liberum said the increase in the state pension age amongst women was ‘probably the key driver’. Higher life expectancy was also a likely factor.

Baroness Altmann, another former pensions minister, said the ‘huge pension gender gap’ between retirement incomes –caused by women in many cases possessing smaller pension pots having often spent less time in paid work, or being paid less than men – was another reason.

The ONS figures showed while the number of women aged 65 and over in work rose by 24.4 per cent over the year to January, there was a 3.9 per cent increase among men of that age. Overall, among those aged 65 and over, the number in work jumped by 11.9 per cent or 168,000 to a record 1.58 million.

That was by far the biggest percentage increase of any age group.

The employment rate of 12.3 per cent among those 65-plus is an all-time high and has doubled over the past two decades. For women aged 65 and over, it stands at 10 per cent for the first time on record – up from 4 per cent 20 years ago.

But men of the same age are still more likely to be in work, with an employment rate of 15 per cent, up from just under 9 per cent over the same period.

Meanwhile, the employment rate for 18-24-year-olds has fallen over the past two decades from 66 per cent to 59 per cent.

The ONS figures showed while the number of women aged 65 and over in work rose by 24.4 per cent over the year to January, there was a 3.9 per cent increase among men of that age

The increase in older women working comes after a period when the state pension age has risen from 60 to become the same as for men, at 65, before rising further to 66. It will increase even more to 67 by 2028.

Those changes were controversial because some women born in the 1950s argued that they had not been given sufficient notice –though a campaign by the Women Against State Pension Inequality (Waspi) for billions in compensation has been rejected by the Government.

Another blow to older people’s incomes came when Rachel Reeves last year decided to remove Winter Fuel Payments for millions of pensioners.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: ‘Changes to state pension age will be a key driver behind women aged over 65 being in the workforce.

‘At £11,502 for the full amount it forms the backbone of people’s retirement income with many people unable to afford to retire until they start receiving it. Added to this, many retirees enjoy remaining in work for longer – they like the social interaction as well as the extra income which can supplement their day-to-day income as well as enable them to keep contributing to a pension so may choose to remain in work, even on a part-time basis.’

Baroness Altmann said: ‘I would think the rise in employment is related to lack of pension for women and the huge gender pension gap.

‘It’s fine for women well enough to work and who are unaffected by the age discrimination still rife among employers. But for others? This would not be good at all.’

Danni Hewson, of investment platform AJ Bell, said of the figures: ‘It is notable that the previous high was surpassed following the announcement by the Chancellor that the winter fuel allowance would be means tested and suggests this may have spurred thousands more women to seek work.

‘Though money worries will undoubtedly have played a part in the decision of many of these women to return to the workplace, or perhaps take a job for the first time, it’s important to also consider much has been done to promote the employability of older workers.

‘The experience, expertise and life learnings can be a brilliant addition to a workplace. Many employers have changed their employment criteria to ensure applications from older workers aren’t overlooked.’