The typical homeowner is paying £2,829 more on their mortgage each year than they were in 2022 thanks to rocketing interest rates.

This means that the average mortgaged homeowner is paying £12,754 per year, according to the estate agent Savills.

Meanwhile, tenants in privately rented homes paid £2,195 more a year on average.

This means that the annual bill for the average household renting has reached £14,458, it said.

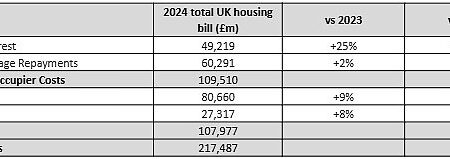

British households – both renters and homeowners – spent a record £217billion on housing costs last year

Total housing costs were £8.6billion higher in 2024 than the previous peak in 2016, when adjusted for inflation.

On the up: British households spent a record £217bn on housing costs in 2024

People living in London incurred a quarter of the total annual 2024 housing costs alone, stumping up £54billion in mortgage repayments and interest or rent.

Britain’s total housing costs increased by £41.2billion in the last two years, accounting for 60 per cent of the total rise in the past decade, Savills said.

There was a £19.8billion upturn in the past year alone.

Why is housing so expensive?

In total, the bill for Britain’s 8.5million mortgaged owner-occupiers reached £110billion last year.

This meant the average mortgaged homeowner was paying £12,754 per year, so £2,829 more than in 2022. However, 9.6million unmortgaged homeowners remained unaffected.

The spike in costs was largely driven by mortgage interest repayments, which have increased by 32 per cent in the last two years.

Lucian Cook, head of residential research at Savills, said: ‘Mortgage rates eased last year, but the higher costs incurred by households reflect the number who had come to the end of a fixed-rate-deal or moved home.

‘While mortgage rates are projected to fall further this year, there are still a significant number of households that are due to come to the end of five-year fixed-rate deals later this year and will be facing an increase in their household bill.’

At the end of 2022, the average two-year fixed mortgage was 6.01 per cent, according to Moneyfacts, but by the end of 2024 this was 5.47 per cent.

Rates peaked in August 2023, when a two-year fix was 6.86 per cent.

In comparison, total costs for tenants were £81billion last year.

The annual bill for the average household renting reached £14,458, after increasing by £2,195 in the last two years.

Cook said: ‘While rental growth slowed in 2024, a significant uptick in the total rental bill reflects the time for historical growth to feed into the amount people pay.

‘Across the country rents have hit an affordability ceiling, but tenants are still left spending a larger proportion of their income on rent than at any point in the last 20 years.’

Honing in on London, Savills said: ‘Here, tenants have borne the brunt of rental growth and are typically the most exposed to higher mortgage costs.’

The north east of England saw the smallest uplift in total housing costs. Across the north east, housing costs have risen by 17 per cent over the past two years.

Comparisons: Mortgage interest has jumped by 37% since 2022, Savills said

Location focus: A table showing total housing costs by location

Last week, the Bank of England kept interest rates on hold at 4.5 per cent. Only one member of the eight-strong Monetary Policy Committee voted in favour of reducing interest rates to 4.25 per cent.

Analysts think the base rate will fall this year, which will, over time, help bring some people’s mortgage costs down.

Ben Thompson, deputy chief executive of broker Mortgage Advice Bureau, said: ‘Right now the tussle is between inflation and economic growth.

‘The Bank of England today has shown it’s more worried about inflationary pressures than the current woeful GDP figures.

‘Many believe this worry will shift later in the year and we may get another rate cut or more, but for now the inflation genie needs to go back into the bottle, hence no rate change.’

Myron Jobson, senior analyst at investment platform Interactive Investor, said: ‘When the Bank of England will cut interest rates next remains the burning question. The financial markets are pointing to May – although there are no guarantees.’