- Homes for sale are up 11% annually, with further increases expected

The property market is being swamped with listings, according to latest data from Zoopla.

There are 11 per cent more homes for sale compared to this time last year, the property portal says. It means the average estate agent now has 33 homes for sale compared to 29 last year.

The number of homes for sale is set to rise even further as the market enters the spring selling period. Nearly 30 per cent of listings typically launch between March and May.

This will boost the choice for home buyers even more, strengthening their hand in negotiations.

The glut of homes on the market is translating into slowing house price growth.

House price growth has slowed to 1.8 per cent, according to Zoopla as spring surge in homes for sale reinforced buyers market

The annual rate of house price growth dipped to 1.8 per cent in February, down from 1.9 per cent in January.

Zoopla says this is likely to slow further in the coming months due to more homes on the market but also due to increasing stamp duty costs.

From 1 April, the nil-rate threshold, under which no stamp duty is paid, drops from £250,000 to £125,000, returning to where it was before temporary changes were made in 2022.

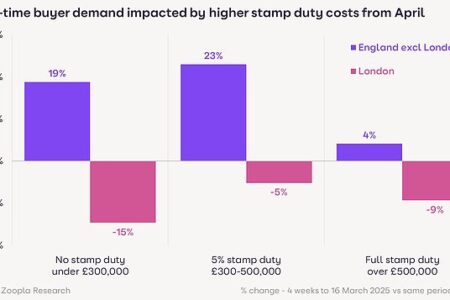

First-time buyers will see their nil-rate band threshold drop from £425,000 to £300,000.

This means, for example, a home mover buying a £400,000 property will see their tax bill rise from £7,500 to £10,000, while a first-time buyer purchasing that same property will see their bill rise from nothing to £5,000.

Richard Donnell, executive director at Zoopla said: ‘House price growth is set to moderate further as supply grows and the extra costs of stamp duty in England feed through into house prices.

‘A slowing in house price growth is not a major concern although the market needs some growth in prices to encourage sellers to come to market and buyers to make realistic offers on homes for sale.

‘There is plenty of demand for homes but also lots of choice. Households looking to sell their home in 2025 need to be careful when setting their asking prices if they are to attract sufficient demand to agree a sale.’

Another factor that may propel more homes onto the market is council tax.

From 1 April, an estimated 150 councils across the UK are set to double council tax on second homes, further boosting supply in areas with a greater share of second homes, such as the South West of England.

This can already be seen in locations where double council tax is already happening. Prices have fallen 0.8 per cent in Truro and 0.7 per cent in Torquay in the South West, both second-home hotspots.

Eight in 10 first-time buyers in London will pay stamp duty from April 2025, compared to less than half under the current thresholds

Aside from more homes coming onto the market, mortgage rates have not fallen this year. Most buyers continue to secure rates between 4 and 5 per cent.

Zoopla says mortgage rates are currently averaging 4.4 per cent for a five year fixed rate.

That’s up from 4 per cent in late 2024, which means buying power has actually reduced in recent months

While rates could fall as the year progresses, it is also just as likely that they will not get any lower – and perhaps even go higher.

‘Doubt remains over how quickly mortgage rates will fall,’ said Tom Bill, head of UK residential research at Knight Frank, ‘particularly if the spring statement isn’t well-received by financial markets and inflation stays stubbornly high due to the more adverse employer landscape from April.

‘We also face months of uncertainty over how US trade tariffs may make life more difficult for UK borrowers.’

What’s happening across the country?

There are more buyers out house hunting in southern England than there was a year ago, according to Zoopla. However, this is still failing to keep pace with the increase in homes for sale.

The property portal says this explains why house price growth is low across southern England, including London, the South East, South West and Eastern regions.

At a local level, house prices are falling in Dartford, down 0.8 per cent, Ipswich down 0.2 per cent and in north west London, down 0.1 per cent.

London is also the only area of the country where buyer enquiries are below where they were a year ago.

It may go from bad to worse for London given that eight in 10 first-time buyers in the capital will pay stamp duty from April 2025, compared to less than half under the current thresholds.

London is the only area of the country where buyer demand is lower than a year ago

Matt Thompson, head of sales at London estate agent Chestertons is still confident of a busy spring

He says: ‘Despite the recent rush of first-time buyers entering the market to beat the stamp duty deadline having slowed down, sellers anticipate a busy spring market.

‘We have seen an increasing number of homeowners listing their property for sale in March which is currently creating a greater choice for house hunters.’

Away from southern England, better affordability for home buyers is resulting in greater potential for house prices to increase at a faster rate.

In northern England, the Midlands and Scotland, buyer enquiries are up 10 per cent higher than a year ago, while the supply of homes for sale has grown more slowly.

This is supporting above-average house price growth which is running 3 per cent higher in the North West and 2.5 per cent higher in Scotland over the last year.

At a more local level, in Scotland, house prices are rising fastest in Motherwell, up 4.3 per cent and Kirkcaldy, up 3.8 per cent.

In Northern England prices are rising over twice as fast as the national average in Wigan, Blackburn, Lancaster and Bradford.

In all of these areas average house prices are between £130,000 and £220,000 versus a national average of £267,500.